Alphabet Beats Apple as Most Valuable Company

Google’s parent company, Alphabet, has beaten Apple as the most valuable company in the world after its latest earnings report. It is said that the company had made a profit of $4.9bn for the fourth quarter which is an increase from $4.7bn from last year. With this announcement, its share price increased as much as 9% in after hours of trading.After hours trading is:

- When investors tends to buy and sell shares beyond the regular opening hours of main exchanges

- Adopted in 1990 by financial institutions together with some rich investors, the growth of online trading gave rise to ordinary investors indulging in online trading some years later

- It existed since big financial institutions preferred to trade big blocks of shares, 24 hours a day

- Unsafe than trading during regular hours, the trading volumes tends to be lower and the share prices could be more volatile, which means that the range between buying and selling prices of shares could be wider

- With insufficient knowledge it could be hard to work out what is behind some after-hours price movements, putting small investors at risk, though potential profits could be higher.

Mobile – Big Head Win for Google

Alphabet would now be worth around $568bn, when compared to Apple that tends to have a value of $535bn. It has been the first time that Alphabet had separated the results of its Google business which comprises of the search engine as well as YouTube, from its `other bets’ business that tends to include added experimental ventures like self-driving cars together with internet balloon programs. Alphabet, on a yearly basis had made $16.3bn, however the figure portrays that the `other bets’ business had lost $3.6bn during that time when the operating income of Google had increased to $23.4bn, as the online advertising had increased. Neil Doshi, managing director of research at Mizuho Securities had commented that `it looks like Google tends to continue executing on mobile (advertising)’.

According to him, `two or three years back, mobile had been a big head win for Google. There had been apprehensions of negative impact on its desktop business, however as mobile tends to take over for more searches; mobile ads have become closer in value to the desktop ads’. Recently, Apple had faced penalty for not sharing adequate big ideas for the future and Alphabet had been rewarded for spending big on its various technology gambles.

Company in the Midst of Tax Row in UK

The company had been through a rough phase, to be more transparent over how much cash it had been spending on things like driverless cars, Google Glass and internet-enabled helium balloons. Last year it turned out to around $3.6bn, however with the Google side of Alphabet doing much better, it was not of much concern. As long as things tend to stay that way, Alphabet could continue to be an attractive proposal for investors. Advertising was the big gain for the company and all important paid-for clicks, where the advertisers tend to pay per person who clicks on the ad, had increased by 31% all over the internet and 40% on Google owned sites.

Apple had become the most valuable company of United States in 2010 when it had displaced Microsoft, who in turn had overtaken IBM two decades earlier. In the meantime, the revenue cost had increased to $1.92bn in UK in the fourth quarter. Since it is such a large part of the business, it is the only territory beyond the US for which the company tends to break down its figure. Presently the company is in the midst of a tax row in the UK after its agreement to pay £130m back in taxes which stretch back to 2005 and the agreement has been seen by some as too light for the internet giant.

Why Your Link Building Efforts Might Fail

Why Your Link Building Efforts Might Fail  How to Request or Give Remote Control in a FaceTime Call on iPhone

How to Request or Give Remote Control in a FaceTime Call on iPhone  The Rise of Intelligent Automation in Business Operations

The Rise of Intelligent Automation in Business Operations  The Best Ideas for Designing Your Custom Printed Ring Binder

The Best Ideas for Designing Your Custom Printed Ring Binder  How Technology is Changing the Way We Play Hearts

How Technology is Changing the Way We Play Hearts  The Rise of Open Source: A Journey to Innovation and Collaboration

The Rise of Open Source: A Journey to Innovation and Collaboration  How SD-WAN Is Revolutionizing Business Networks

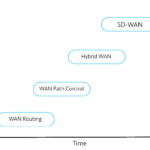

How SD-WAN Is Revolutionizing Business Networks  Effective Digital Advertising Strategies for Modern Businesses

Effective Digital Advertising Strategies for Modern Businesses  Tips for Marketing Dental Packages: Easy Ways to Grow Your Reach

Tips for Marketing Dental Packages: Easy Ways to Grow Your Reach